Supply Chain Reality in China: Enforcement, Costs, and What Buyers Get Wrong

China’s supply chain is changing again.

Not in headlines.

Not in speeches.

And not in a way that’s obvious from outside China.

But for companies actually paying suppliers, moving money, and trying to ship product, the shift is already here.

At China Agent, we don’t rely on theory or media narratives. We work inside China, every day, verifying factories, monitoring payments, and resolving problems when things go wrong. What we’re seeing now is a structural tightening that buyers need to understand clearly.

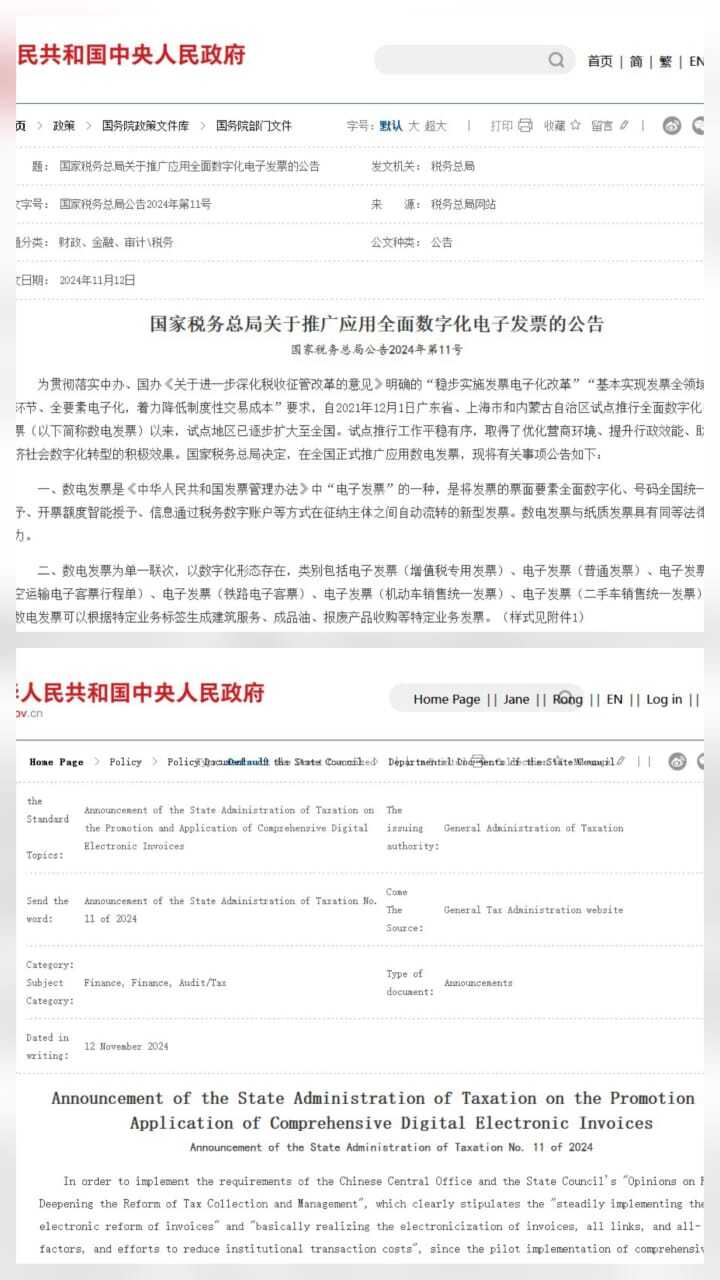

This Is Not a Policy Announcement. It’s Enforcement.

China rarely announces major operational changes in a way that foreign buyers can easily track. Instead, change shows up in execution.

Right now, enforcement is tightening across the most sensitive parts of the supply chain:

- Payments

- Invoicing

- Platform transactions

- Bank scrutiny

- Supplier behavior

This isn’t about one regulation. It’s about multiple systems moving in the same direction.

What We’re Seeing on the Ground

These are not assumptions. These are issues we are dealing with daily.

- Payments on domestic platforms increasingly require valid invoices (fapiao)

- “Pay now, invoice later” is disappearing

- Banks are cross-checking wires against invoices

- Both company and private accounts are being reviewed

- Personal transfers tied to business activity are flagged

- Hong Kong → China payments are delayed or questioned

- Platforms are reporting transaction data to authorities

- Suppliers are less willing — or less able — to operate informally

The old workaround culture is breaking down.

Why This Matters More Than Buyers Think

For years, many supply chains worked not because they were clean, but because the system tolerated gray areas.

That tolerance is shrinking.

When enforcement tightens:

- Costs surface

- Cash flow slows

- Supplier promises change

- Weak factories get exposed

Buyers who built pricing on assumptions rather than verification feel this first.

Dumping, “Cheap China,” and the Real Cost Problem

A major reason China remained competitive for so long was the ability to sell products below their true cost.

Not always illegally — but enabled by:

- VAT leakage

- Informal rebates

- Currency insulation

- Platform opacity

- Flexible payment practices

As these mechanisms tighten, dumping becomes harder to sustain.

What replaces it is simple: real pricing.

This is why many buyers are suddenly facing price increases that suppliers can’t explain clearly — or don’t want to explain at all.

Currency: Why the RMB–USD Move Is a Warning Sign

There’s a lot of confusion around currency.

From an operational perspective, what matters is this:

For exporters today, the RMB–USD situation is negative.

- Local costs are rising

- Taxes are visible

- Compliance is enforced

- Margins are under pressure

Currency movement does not offset this reality. It does not restore margins. It does not solve the cost problem.

What it does is delay the impact.

So when currency pressure appears at the same time as tighter enforcement across payments, invoices, platforms, and accounts, it’s not random. It’s a signal that stress inside the system is increasing.

China Is Not Closing — It’s Raising the Bar

Another mistake buyers make is assuming tighter enforcement means China is becoming inaccessible.

That’s not accurate.

China is becoming harder to operate in informally, not harder to operate in correctly.

We see:

- Higher entry standards

- More scrutiny on ownership, licensing, and tax status

- Less tolerance for unclear structures

At the same time, China is opening selectively, under strict rules.

Initiatives like Hainan / Sanya are examples of controlled access — designed to attract capital and business under frameworks China can monitor and enforce.

The message is clear:

China still wants business.

But only on terms it can control.

Why Buyers Get Caught Off Guard

From outside China, everything still looks familiar.

Factories respond.

Prices get quoted.

Production continues.

But under the surface, the rules are shifting.

When problems hit, they don’t arrive as warnings. They arrive as:

- Frozen payments

- Missing invoices

- Delayed shipments

- Non-cooperative suppliers

- Sudden price changes

At that point, options are limited.

What Buyers Should Be Doing Now

Companies that navigate this successfully do not wait for a crisis.

They:

- Verify suppliers properly — licenses, tax status, capacity

- Understand how suppliers actually invoice and receive money

- Test payment flows before scaling orders

- Recalculate real landed costs under current enforcement

- Reduce dependence on single suppliers or opaque structures

This is not about panic.

It’s about preparation.

How China Agent Helps

China Agent exists for exactly this environment.

We help companies:

- Verify factories and trading companies before money moves

- Confirm legal, tax, and operational reality — not promises

- Identify risk in payment and invoicing structures

- Catch problems early, while they are still fixable

- Protect funds, timelines, and supply continuity

We don’t sell shortcuts.

We sell clarity.

Final Thought

China’s supply chain is not collapsing.

But it is becoming less forgiving.

Systems that relied on flexibility, opacity, or assumptions are being tested.

Buyers who understand this early can adapt.

Buyers who ignore it usually learn the hard way.

In China, proof always matters more than promises.